2023… ESG and sustainability projections for mid-market businesses and organisations

2023… ESG and sustainability projections for mid-market businesses and organisations

Original content provided by BDO United Kingdom

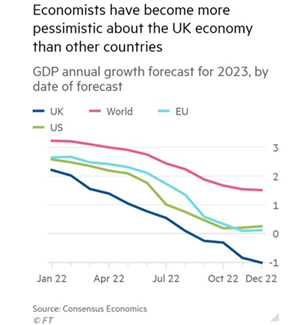

The forecasts are not getting better for the UK economy; with words like ‘tough’, ‘bleak’, and ‘grim’ being bandied about. The IMF in its annual economic outlook is projecting that growth across the world in 2023 is expected to be weak. The weakness in growth is due to three global issues: high inflation accompanied by central bank tightening, the continued war in Ukraine, and the lingering effects of COVID-19, especially the development of the disease in China. The view from the EU is just as challenging, as the FT survey of economists point to shrinkage in the eurozone, again siting high inflation and the probability of energy shortages, which will depress output and the labour market. The UK is expected to face the worse downturn of any major economy, according to the Organisation for Economic Co-operation and Development (OECD). With all this doom and gloom, how can ESG and sustainability strategy help UK mid-market companies survive and even thrive?

The investment at this time on ESG and sustainability strategy could lead to resilient companies who will be better able to weather the economic headwinds.

ESG a Buffer

But how does ESG and sustainability investment impact in the face of economic bad news? Traditionally, ESG or sustainability within organisations have been seen as a cost, but with changes in the economy, smart organisations now see the monitoring and management of these issues as an investment. Indeed, ESG or sustainability can lead to resilience and robustness in the face of economic challenges.

The impact on businesses and how ESG can help

The current economic difficulties and the predicted recession will feature several characteristics that will be keeping management teams up at night.

Implementing sustainable policies can help mid-market companies mitigate and overcome these the challenges relating to the recession they will face in the coming year. The key point is that companies should think of ESG policies as an investment in resilience and sustainability rather than an unwanted cost. These policies will reduce the environment of businesses but more importantly they can improve the bottom line too.

Rising cost of raw materials

With inflation running in double digits, you may find that supply chain essentials like intermediate goods are more expensive than they used to be. Stricter budgets, cuts in discretionary spending and paring down investment may reduce the symptoms temporarily but will not address the underlying issues and inefficiencies.

Monitoring ESG and sustainability data will help identify areas of waste and inefficiencies within the supply chain. As the cost of raw materials climbs, reducing waste and inefficiency improve resilience and drive overall enterprise value.

Falling household spending

Rising energy costs, falling real wages, frozen income tax allowances and higher mortgage payments are all reducing discretionary consumer spend and businesses can expect their customers to be more selective on how they do spend any available cash.

Establishing and effective communicating bone fides relating to ESG and sustainability can encourage customer loyalty and support the brand value of a company. Shareholders will be sensitive to the behaviour of companies and their approach ESG, and how to avoid greenwashing.

Rising unemployment

In a recession, companies often reduce their staffing levels to save money. Yet, for clever companies, establishing and communicating ESG credentials will strengthen brand and help you keep hold of the most productive and valuable staff. Improved staff engagement will also enhance productivity.

Lack of economic growth

It is generally accepted that there will be little or no growth in 2023. This means that making the case for any investment is harder. Adopting an approach based on materiality, as is key to understanding ESG and sustainability effort, the exercise will help confidently identify where investments can be more productive and streamlining allocation of resources can be achieved without compromising quality or company value.

The right time to invest in ESG

Business leaders should see that now is the right time to invest in the sustainability strategy that will support more efficient and resilient companies; helping to mitigate future economic headwinds.

Our experience is that investors are ahead of the curve when it comes to measuring and monitoring ESG and sustainability risks. There is an active market for ESG and sustainability linked financial products for companies who understand how to manage sustainability risks and data effectively, opening of markets and reducing the cost of capital through wholistic risk management.

Smart business leaders are coming to the realisation that managing and highlighting ESG and sustainability wins can strengthen positions within the market and have a positive influence on stakeholders.

ESG, recession and the mid-market

The points made in this article are true for all companies. However, there are some actions that are unique to entrepreneurial, mid-market companies and their ESG or sustainability journey.

In previous iterations of weak or challenging economies, companies have seen ESG or sustainability activities as a cost. SMEs should not fall into the trap of previous down turns in the economy and throw away or stop exploring how ESG and sustainability issues can support enterprise value. As dynamic and entrepreneurial businesses, mid-market companies can harness the benefits of investing in ESG and sustainability. They can quickly and easily position themselves as more resilient and adaptable to change and use that positioning right across operations.

Mid-market companies are the engine of the economy and an essential element of the supply chains of larger businesses. They can gain a competitive advantage through sustainability by;

-

proactively address sustainability in RFPs

-

reducing the cost of staff recruitment and retention

-

reduce the cost of capital and insurance premiums

-

reduce waste and inefficiencies through agile allocation of resources

Supporting your investment in ESG and sustainability

We are specialised in working with the UK’s mid-market businesses that are the engine of the UK economy. However, we work with a range of companies of all sizes and in all sectors and regions. Our experiences with our clients in recent years have taught us both the importance of resilience and the value of business intelligence.

Many of our clients are working with us to embed ESG and sustainability into their business strategies and their communications. This work is key to communicating the value of making the kinds of investment advocated in this article.

Environmental regulation is also evolving fast and placing new requirements on businesses which can be hard to keep up with. We are working with clients to look beyond mere compliance, such as requirements around EU SFDR and FCA’s SDR and instead focusing on the value created by understanding the risks and opportunities in ESG and sustainability policies.

In both cases, our clients benefit from the wealth of expertise and growing experience of the BDO international network. BDO member firms are collaborating and sharing experiences so that they can provide their clients with the services, tools and best practice they need to address ESG and sustainability effectively.

The services we have provided to clients include:

-

ESG and sustainability materiality assessments

-

ESG and sustainability strategies

-

ESG and sustainability data gap analysis

-

Accounting and corporate reporting advisory – e.g., TCFD reporting

-

Digital tools to improve financial, human, and intellectual resource allocation

-

Streamlining of reporting requirements

-

Strategy and business intelligence based on our ESG and sustainability expertise

-

ESG maturity assessment and advising on next steps in the evolution of ESG strategy

-

Guidance on ESG and sustainability regulations and legislation

If you would like further information, contact our team: Michael Jennings, Pamela Gillies and David Warnock.